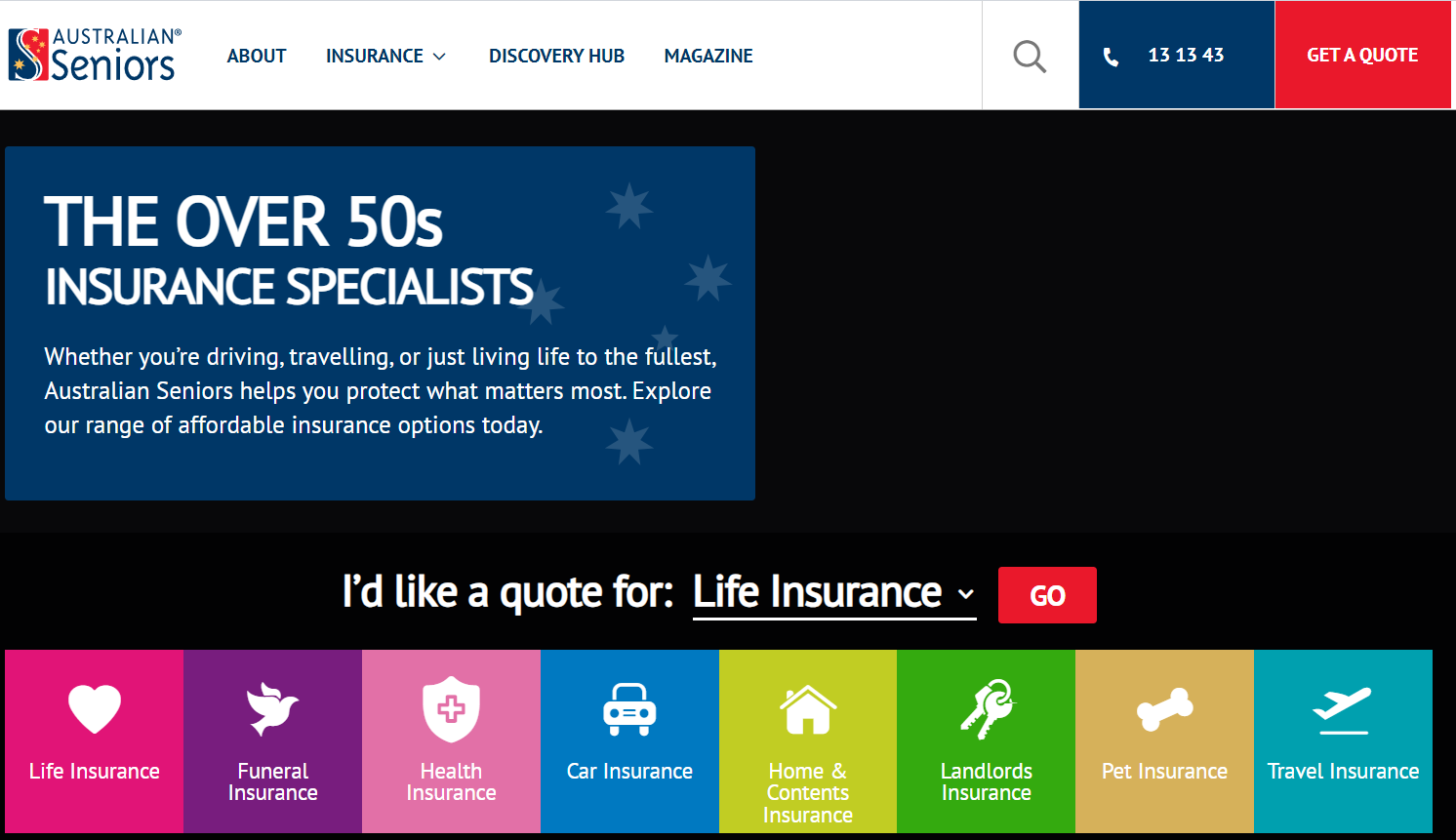

Australian Seniors Insurance is a reliable and complete way to protect your future. It is made to meet the unique needs of older Australians. As we age, it becomes more critical to have the proper protection. Australian Seniors Insurance has policies designed to meet seniors’ needs and give them peace of mind. These policies can help protect your health, funds, or loved ones.

There are many plans to choose from at Australian Seniors Insurance, so you can find one that fits your budget and way of life. These plans are made to help adults with the problems they face. For instance, health insurance can pay critical medical bills, and life insurance can protect your family’s financial future. It’s also easy to understand your service and make intelligent decisions because the process is transparent and straightforward.

Why get Australian Seniors Insurance? It’s not just to meet your needs now; it’s also to plan for the future. The right insurance can make the difference between not knowing what to do and being sure of yourself as you retire. By getting insurance now, you’re taking steps to ensure that unexpected events don’t make your life or the lives of your family members harder.

Even though the future is unclear, Australian Seniors Insurance can help you plan for a safe and happy life. Many adults across the country trust this insurance company because it offers flexible plans and low premiums and works hard to ensure its customers are delighted. Australian Seniors Insurance can help you think about the future and give you peace of mind by providing care for you.

Table of Contents

Why Australian Seniors Insurance is Vital for Retirement Planning

When you quit, you should enjoy what you’ve worked for but also make sure you have enough money and peace of mind. For older Australians, Australian Seniors Insurance is an important part of retirement planning because it gives them coverage that fits their needs. Getting the proper insurance to protect your things, health, and family is essential when you get close to retirement.

Being cheap and flexible is one of the main reasons Australian Seniors Insurance is an excellent retirement plan. You can choose coverage that fits your budget and way of life from a wide range of plans for adults. Whether it’s health insurance to cover sudden medical costs or life insurance to protect your family financially, these plans are meant to give you peace of mind in your older years.

Insurance for seniors in Australia can also help you deal with the risks that come with getting older. It’s getting more and more expensive to get good health care, so having full health insurance is essential to make sure you can still afford it. Also, life insurance can pay for your funeral and other costs connected to your death. This can help your family financially during this challenging time.

Planning for Australian Seniors Insurance when you leave is a thoughtful way to protect your future. You won’t have to worry about money problems in retirement if you buy the right insurance now. If you include Australian Seniors Insurance in your retirement plan, you can be sure that you are ready for anything that may come your way.

Key Benefits of Australian Seniors Insurance Coverage

Senior insurance in Australia is meant to give older people peace of mind and financial security in several ways. As you get older, having the right insurance is more important than ever. Australian Seniors Insurance is made to meet the needs of seniors.

One great thing about Australian Seniors Insurance is that it doesn’t cost too much. There are different plans for different price ranges, so you can find security that doesn’t cost a fortune. They offer affordable and complete options for people needing life, health, or funeral coverage.

Another significant benefit is that it gives you options. There are different plans from Australian Seniors Insurance, so you can choose the one that best fits your needs and way of life. A life insurance policy can give your beneficiaries a lump sum payment when you die. This can help you ensure that your family is taken care of financially after you die. On the other hand, health insurance can help you pay for medical care without worrying about money. This way, you can be sure you get the care you need.

Australian Seniors Insurance also gives seniors peace of mind by providing them with security made just for them. Thus, you can be sure that your chosen plans are best for your age and will keep you safe.

How Australian Seniors Insurance Safeguards Your Loved Ones

Getting Australian Seniors Insurance is a great way to safeguard your future and your family’s future. It’s more important than ever to ensure our family members are cared for and have enough money as we age. Several plans from Australian Seniors Insurance are designed to keep your family from having to think about money when times are tough.

Australian Seniors Insurance does this in several important ways. One of these is through its life insurance plans. These plans give your family a lump sum payment if you die. Your family shouldn’t worry about money during this difficult time. This money can help pay for the funeral, unpaid bills, or even daily living costs.

Australian Seniors Insurance may also cover funeral insurance, which pays straight for planning your funeral. This kind of insurance makes sure that your friends and family don’t have to think about how to pay for and plan your funeral. On the other hand, they can remember and respect your life.

When you get health insurance through Australian Seniors Insurance, you and your family are protected because you can get good medical care. These plans help you keep your savings by paying for medical bills that come out of the blue. This way, your family won’t have to pay for your medical care with their own money.

Understanding the Different Types of Australian Seniors Insurance

Different types of policies from Australian Seniors Insurance meet the wants of older Australians. If you know about the various kinds of insurance, you can pick the one that will protect your future and give you and your family peace of mind.

One type of Australian senior insurance that many people get is life insurance. This insurance will give your beneficiaries a lump sum payment if you die. It’s essential to ensure your family is cared for financially by helping them pay for funeral costs, bills, and even daily living costs.

Another common choice is funeral insurance. Because this coverage specifically covers the costs of funeral preparations, your loved ones won’t have to worry about these costs during a hard time. You can pick a plan from Australian Seniors Insurance that covers the total cost of your funeral so your family can focus on honouring your memory.

You can also get health insurance specially made for adults. As people age, their healthcare needs tend to grow. Having full health insurance can help pay for medical care, hospital stays, and other healthcare services. This kind of insurance is crucial to maintaining your quality of life and preventing sudden medical expenses from straining your finances.

Lastly, people still working in their senior years can get income protection insurance. This policy ensures that your income stays steady by providing money if you get sick or hurt and can’t work. Steps to Choose the Right Australian Seniors Insurance Plan

Picking the right Australian Seniors Insurance plan is important to ensure peace of mind and financial security in your later years. There are many choices, so follow a few simple steps to get the service that best fits your needs.

First, think about what you need. Consider what you want the insurance to cover: life insurance to protect your family, health insurance to pay for medical bills or funeral insurance to pay for costs related to your death. Figuring out what you need will help you narrow down your choices.

Next, compare various plans. Australian Seniors Insurance offers several plans, each with its own pros and cons. Compare these plans by looking at their coverage limits, premiums, and what they don’t cover. Use comparison tools or talk to an insurance agent to make an educated choice.

Third, consider your budget. It is essential to pick a plan that gives you enough security without breaking the bank. Look for policies that offer a good mix of affordability and complete safety. Remember that the cheapest choice is only sometimes the best regarding coverage.

Reading the small print is another crucial step. Ensure you know the policy’s terms and conditions, such as waiting times, what it doesn’t cover, and how to file a claim. This will keep things from coming as a surprise later on.

Lastly, if you need to, get help from a professional. Someone who works in insurance can give you good advice and help you pick a plan that fits your wants and budget.

Common Myths About Australian Seniors Insurance Debunked

There are a few myths about Australian Seniors Insurance that can make it complicated for seniors to get the coverage they need. If you know about these false beliefs, you can make intelligent choices and get the right insurance for your needs.

Myth 1: “Insurance for seniors costs too much.” Many people think that seniors’ insurance is too expensive for them to afford. However, Australian Seniors Insurance has several low-cost choices for people with different budgets. There are many plans to choose from, so you can find coverage that fits your budget without giving up important security.

Myth 2: “Being healthy means I don’t need insurance.” People also often wrongly think that you don’t need insurance if you’re healthy. Although being healthy is good, accidents and sickness can still happen. No matter your health, Australian Seniors Insurance is a great way to protect your financial future and pay for unexpected medical bills.

Third myth: “Every policy is the same.” Some people think that all insurance plans for adults are the same. Indeed, policies are very different in what they cover, what perks they offer, and what they don’t cover. It’s essential to look at several plans to find the one that best fits your wants and tastes.

Myth 4 says, “It’s too late to get insurance now.” A lot of older people think they’re too old to buy insurance. That being said, Australian Seniors Insurance has plans for people of all ages, so you can still get coverage even as you get older.

How to Get the Best Value from Your Australian Seniors Insurance

You need to plan, make intelligent decisions, and handle your money strategically to get the most out of your Australian Seniors Insurance. By doing these things, you can get the most out of your insurance policy and ensure it meets your money and security needs.

1. Figure Out What You Need: To begin, figure out what you need. Figure out what parts of the benefits are most important to you, whether health, life, or funeral. Figuring out what’s most important to you will help you choose a policy that gives you the best rewards.

2. Compare Insurance Plans: Compare several insurance plans side by side. Look for deals that cover many things at a reasonable cost. You can talk to an insurance agent or use online comparison tools to find the best choices for your needs and budget.

3. Read the fine print: Carefully read the terms and conditions of each policy, paying particular attention to coverage limits, limitations, waiting periods, and how to file a claim. Knowing these things will help you avoid unexpected costs and ensure you get what you paid for.

4. Look over your policy often: Check your insurance policy frequently to make sure it still covers what you need. Because life and health can change, you need to make changes to your policy to stay as safe as possible.

5. Look for discounts: Some insurance companies offer discounts or other benefits for getting certain types of coverage or adding more than one policy to one. Find out if any savings could make your insurance more valuable.

Conclusion

Lastly, Australian Seniors Insurance is vital to a well-rounded retirement plan because it provides essential safety and peace of mind for older Australians. If you know about the different types of insurance, like life, health, and funeral insurance, you can make decisions that meet your wants and fit your style.

To find the best insurance plan, consider what you need, look at different plans, and read all the small print. Many people have false ideas about senior insurance, such as how much it costs and whether or not they need it. Busting these myths can help you make better choices. You should know that insurance for seniors is meant to be cheap and adaptable, so you can get full coverage that changes based on your needs.

Figure out what’s most important to you, and then pick a plan that gives you those perks to get the most out of your Australian Seniors Insurance. When you look over your insurance policy often, you can ensure it still meets your needs as your life changes. You can also get more out of your coverage by looking for discounts or other perks.

Busting myths, weighing your options, and planning how to use your insurance can help you get a policy that keeps your money safe and gives you and your family peace of mind. Aussie Seniors Insurance isn’t just a way to protect your money; it’s also a smart way to save for retirement. It’s essential to make intelligent choices and get full coverage to ensure your insurance helps you reach your goals and keeps you safe.